In the State of Indiana, when you get your drivers license reinstated, especially in the instance where you receive SPD or Indiana Specialized Driving Privileges, you will be required to obtain SR-50 insurance coverage.

Indiana’s Proof of Financial Responsibility Law

Again, Indiana takes proof of financial responsibility that you currently have insurance on your motor vehicle very seriously. The Indiana proof of financial responsibility law requires all drivers to maintain financial responsibility coverage on the vehicles they operate. The proof of financial responsibility law states that a driver must show proof of insurance to the Indiana BMV for any moving violation or accident for which you have been convicted. Once notified of the conviction, the BMV will send the driver a Certificate of Compliance. Your auto insurance agent or company must fill out this form. This form must be sent back to the BMV within 40 days in order to avoid a mandatory driver’s license suspension for noncompliance.

SR-50 Auto Insurance is Required in Indiana

The SR-50 auto insurance coverage is a form used by drivers to provide proof of current insurance to the Indiana Bureau of Motor Vehicles. The SR-50 shows the BMV the beginning and end dates of the current auto insurance policy. The SR-50 is specific to Indiana. If it is found that you are without insurance, you may receive an SR-22 insurance requirement. According to the Indiana BMV website:

…with an SR-22 requirement, you must maintain an effective SR-22 policy on file with the Indiana BMV for three (3) years as a result of your first and/or second no-insurance suspension; or five (5) years as a result of your third and subsequent no-insurance suspensions.

Key Takeaways Regarding the SR 50 Indiana Insurance Requirement

- The SR-50 is a BMV generated form, that is unique to the state of Indiana. It is essentially an Affidavit of Current Insurance

- A completed SR-50 Auto Insurance form is required to restore driving privileges after an Indiana operators license suspension

- Once a driver has an Indiana operators license suspended are generally considered as high-risk drivers. It’s this reason that you want to fight any traffic offenses that you may receive

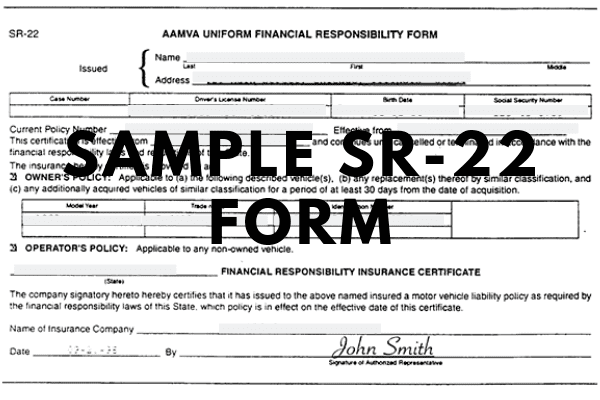

What is the Difference Between SR-22 and SR-50 Insurance

Both the SR-22 and the SR-50 aren’t actually types of auto insurance at all. As a matter of fact, both are forms that are attached to your auto insurance. The SR-22 is a certificate of insurance that proves to the Indiana BMV that you are currently carrying auto insurance. The SR-22 is a certificate of financial responsibility while the SR-50 is proof that your auto insurance policy is in place. It’s very important that the date on your SR-50 insurance form is dated before your automobile incident that required your validation of an auto insurance policy was in place.

Prevent the SR-50 Insurance Coverage Verification Requirement

When you have been convicted of a moving violation or accident you will need to show SR-50 Insurance Coverage. A conviction of a moving violation, like a DUI in Indiana, means not only will you need to prove insurance coverage, but your auto insurance rates run the risk of increasing and you could face a possible license suspension. Call Indianapolis criminal defense lawyer Jesse K. Sanchez at 317-721-9858 today.